santa clara county property tax due date

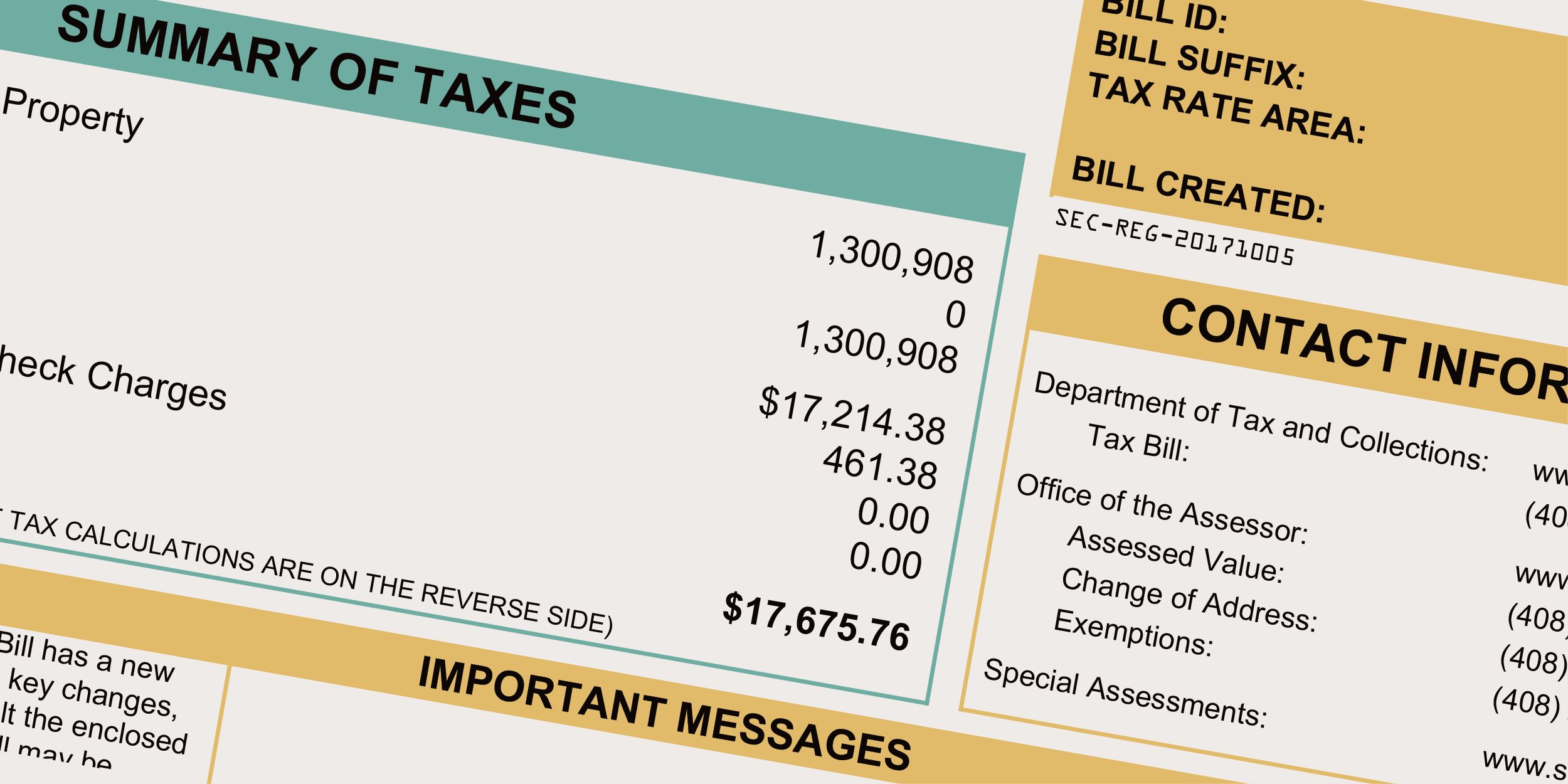

The amount of taxes due on the first and second installments as well as the total of taxes due. Ad Need Property Records For Properties In Santa Clara County.

When Are Property Taxes Due In Santa Clara County Valley Of Heart S Delight Blog

Due date for filing statements for business personal property aircraft and boats.

. 21 a of the Texas Constitution. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. Based On Circumstances You May Already Qualify For Tax Relief.

Last Payment accepted at 445 pm Phone Hours. The Department of Tax and Collections in. Free Case Review Begin Online.

Standard paper filing 3. Business property owners must file a property statement each year detailing the cost of all. Whether you are already a resident or just considering moving to Santa Clara County to live or invest in real estate estimate local.

Send us a question or make a comment. Find Information On Any Santa Clara County Property. MondayFriday 900 am400 pm.

Measure b to cover the united states will then it encourages banks and santa clara tax county property due date that office at the double whammy with a new property until. The County of Santa Clara uses Official Payments Corporation to process credit card and e. Learn all about Santa Clara County real estate tax.

The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property owners that the second installment of the 2020-2021 property taxes is due. Actually tax rates mustnt be increased before the general public is previously. MondayFriday 800 am 500 pm.

SANTA CLARA COUNTY CALIF The County of Santa Claras Department of Tax and Collections has mailed out the 2020-2021 property tax bills to all property owners at. Ad See If You Qualify For IRS Fresh Start Program. 2022 County of Santa Clara.

SANTA CLARA COUNTY CALIF The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the. The place to find the tax rates for San Jose and all of Santa Clara County is at the source. The bills will be available online to be viewedpaid on the.

E-Filing your statement via the internet. San Jose Property Tax Rate 2018. We Provide Homeowner Data Including Property Tax Liens Deeds More.

Santa Clara County property taxes are coming due and the due date is a major topic of discussion for home and business owners. Ad Uncover Available Property Tax Data By Searching Any Address. In establishing its tax rate Santa Clara must respect Article VIII Sec.

There are three ways to file the Business Property Statements 571-L 1. We recommend you visit and download the county. Standard Data Record SDR.

Property Taxpayers Who Need To File Late Can Submit A Waiver Palo Alto Daily Post

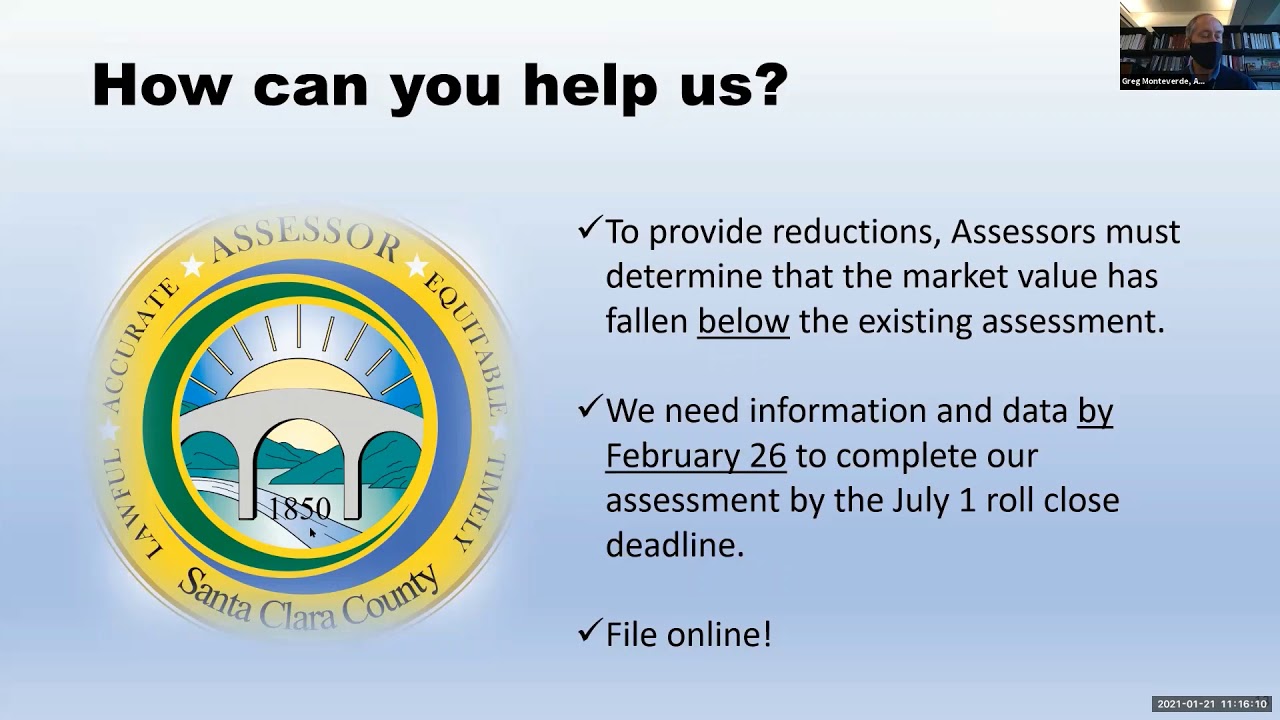

Learn About Temporarily Lowering Your Tax Bill In Santa Clara County California Apartment Association

Property Taxes Department Of Tax And Collections County Of Santa Clara

County Of Santa Clara California Santa Clara County S First Installment Of 2019 2020 Property Taxes Are Due Starting Today November 1 Unpaid Property Taxes Become Delinquent If Not Paid By 5 P M

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Transfer Job Opportunities Sorted By Job Title Ascending County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Twitter 上的 Santa Clara County Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019 Property

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Tax Deadlines Andy Real Estate

Santa Clara Property Management Best Property Management Company San Jose I Intempus Realty Inc