nanny tax calculator free

And because most families use a nanny payroll service handling net gross and direct deposit is all accounted for. 273-3356 or feel free to get started online.

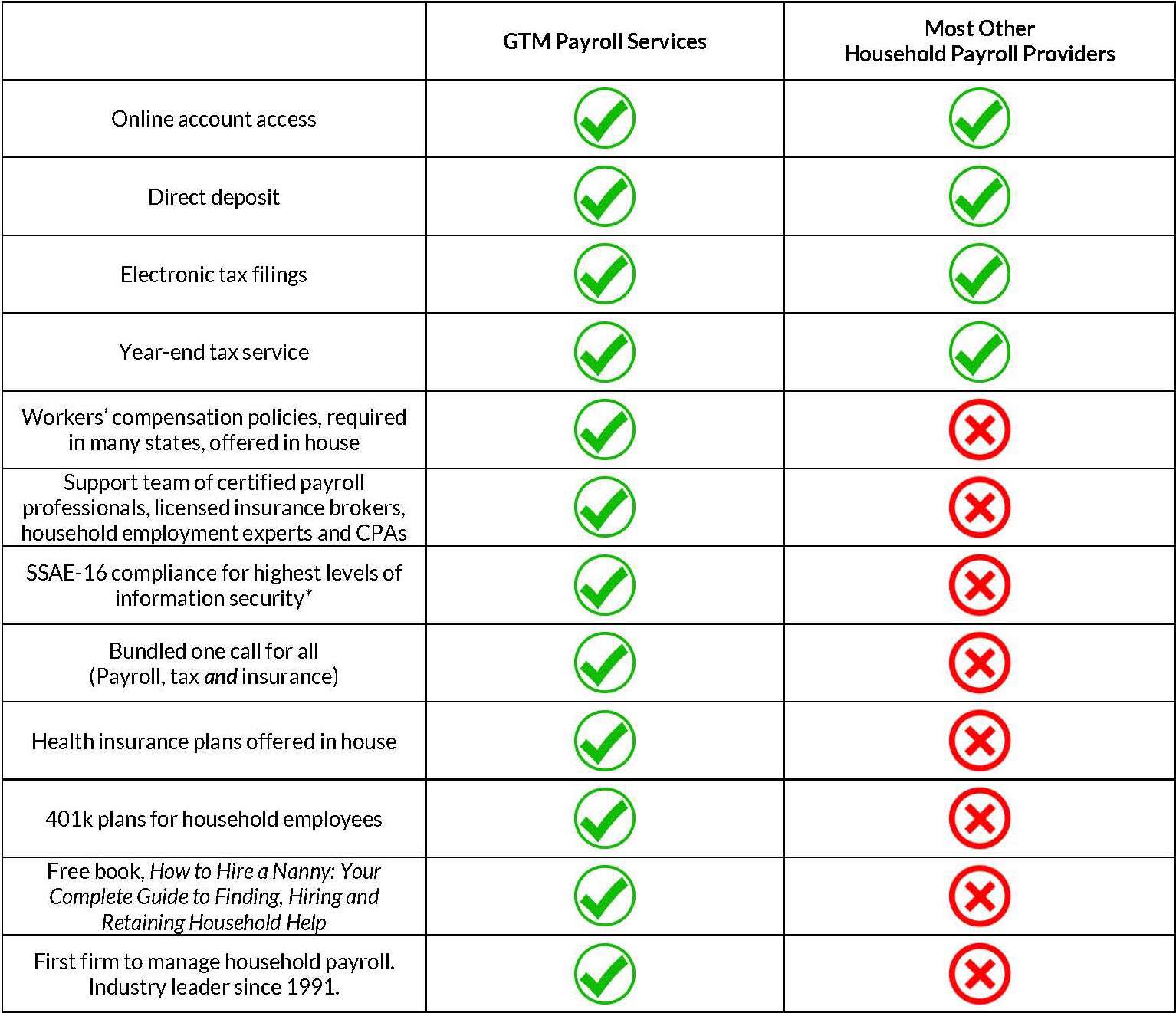

Nanny Payroll Service Comparison Gtm Payroll Services

Most companies will charge you 100 just to prepare a Schedule H making NannyPay an.

. The amount of qualifying expenses increases from 3000 to 8000 for one qualifying person and from 6000 to 16000 for two or more qualifying individuals. The Nanny Tax Company has moved. And if you need a sample nanny contract or access to nanny tax forms before your nanny begins working we have these free.

The user assumes all responsibility and liability for its use. Were here to help. Thats less than everyone else charges per month.

If you choose not to enter a tax code the default 1250L will be applied. We work ONLY with and specialize in hand-holding household employers. The NannyPay calculator with forms costs LESS THAN 200year.

These look something like. Nanny taxes see our detailed guide on what nanny taxes are and if you have to pay them Nanny tax. Please note if you have agreed a net salary both are your.

Just enter the hours and everything is calculated for you. Employers need to withhold around 13-20 of their nannys gross wages to pay for the nanny tax. Then print the pay stub right from the calculator.

Calculation is for April 2022 to June 2022 only. Because some values depend on the year you must enter both the Pay Period End Date and Gross to. Cost Calculator for Nanny Employers.

Our calculator is the heart of the system. This calculator allows you to get an idea of how much you will pay and how much your nanny will take home. Now that you see what it may cost to hire a nanny what your taxes may be and how much you can save with tax breaks take a look at what our nanny tax and payroll service can do for you.

Please note the calculator may not be compatible with all devices and may require. These rates are the default rates for employers in Pennsylvania in a locality that does not have local income tax. Find out how much to pay your nanny.

Student loan repayments can also be take into account. For specific tax advice and guidance please call us toll free at 877-626-6924 and a NannyChex payroll and tax expert will provide you with a free consultation. Our new address is 110R South Prospect Ave Park Ridge IL 60068.

Necessary state taxes such as. Nanny tax calculator free Friday March 11 2022 Edit. The NannyPay calculator with forms costs LESS THAN 200year.

The Nanny Tax Calculator accepts 3 student loan repayment plans ominously they are called. Select the tax code to use or specify other eg for a nanny share or more than one job calculations I confirm the calculation parameters as shown. Employee NIC threshold changes July 2022.

Virginia Extends Quarterly Nanny Tax Filing Deadline Posted by Vanessa Vidal on 11112 530 PM. Use The Nanny Tax Companys hourly nanny tax calculator to calculate nanny pay and withholding. New calculation will be required from 1 July 2022.

With a nanny tax calculator you can. GTM Payroll Services provides this calculator as a means for obtaining an estimate of tax liabilities but should not be used as a replacement for formal calculations and does not constitute the provision of tax or legal advice. The Nanny Tax Company has moved.

One of the best things about being a nanny for a nanny share is that nannies typically make more money working for two families than they would for one. Get a Free Consultation. Good news though NannyPay offers a low-cost and up-to-date software solution for calculating nanny taxes and preparing annual Form W-2s and Schedule H up to 3 employees at no additional cost.

Nanny payroll help can vary from low-cost or free DIY resources to full service companies that cost 500-1200year. The percentage of qualifying expenses eligible for the credit increases from 35 to 50. Our new address is 110R South Prospect Ave Park Ridge IL 60068.

The easiest way for you to estimate your nanny tax obligation is to use a nanny tax calculator. It is then the decision of the employee whether they opt in or out of the scheme you cannot choose for them. For specific advice and guidance please call us at 1-888-273-3356 or consult your tax professional.

Get help from our experts on how to manage your household tax and payroll. Plan 1 plan 2 and Postgraduate loan. Typically on a quarterly basis you will need to file state tax returns.

Using a nanny tax calculator. As for Social Security and Medicare tax payment 765 will be shouldered by the employer and another 765 will be taken from wages 62 for social security and 145 for Medicare. Any employee pension payments will be deducted from the net pay you have supplied.

Our new address is 110R South Prospect Ave. NannyTax offers a complete tax filing service for employers of domestic help. NannyTax LLC was the first firm in the country to specialize exclusively in working with household employers.

If you plan to employ your nanny for less than a year the value stated here will. This calculator is intended to provide general payroll estimates only. The minimum contribution levels are 5 by employee and 3 by employer unless the nanny opts out.

Our free nanny tax calculator will help you calculate your nannys pay and determine your tax responsibility as a household employer whether paying a nanny a senior care worker or other. Just 29 a year. Use our nanny tax calculator to help set your budget.

Use our nanny payroll calculator to help. For tax year 2021 the taxes you file in 2022. As an employer you are obliged to enrol your employee onto a pension scheme.

Download a sample nanny contract. Nanny taxes see our detailed guide on what nanny taxes are and if you have to pay them Nanny tax payroll service for calculating taxes and providing documentation like paystubs and W-2s. Same rules apply for a nanny share.

However in most situations you need to pay 06 for unemployment insurance for the first 7000 you pay your nanny. This is 1547 of your total. Our tax payment calculator quickly gives you the data you need to file quarterly and at the end of the year.

Your exact savings will depend on your household income. Computation of Nanny Tax. File tax returns year-round.

Computation of Nanny Tax. 1250L is the tax code currently used for most people who have one job or pension. Nanny Payroll Tax Calculator.

Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator. You write the checks we do all the paperwork. This is based on the 20222023 tax year using tax code 1257Lx and is relevant for the period up to and including 050722 this will be updated again after this point with the changes detailed in our tax rates and thresholds page.

The beginning of the reduction of the credit is. This calculator assumes that you pay the nanny for the full year and uses this amount as the basis to calculate what you need to pay per month. Nanny tax calculator for a nanny share.

Nanny Me Payroll Deductions How To Payroll Deduction Online Calculator

40 Off Free Account 8 Crypto Tax Calculator Coupon Codes Jun 2022 Cryptotaxcalculator Io

Babysitter Taxes Should A Nanny Get A 1099 Or W 2 H R Block

How Much Should I Pay My Nanny Free Nanny Tax Calculator

W 2 Reporting Required For Nanny Tax Free Healthcare Benefits

How To Pay Your Nanny S Taxes Yourself Nanny Tax Payroll Template Nanny Payroll

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Nannytax Nanny Payroll Services For Uk Employers Nannytax

5 Answers You Need When Using A Nanny Tax Calculator

How To Calculate Your Nanny Taxes

Free Payroll Tax Paycheck Calculator Youtube

The Diy Household Employee Payroll Service Simple Nanny Payroll

Paycheck Nanny Calculate Tax Apps On Google Play

Nanny Tax Payroll Calculator Gtm Payroll Services

Nanny Tax Payroll Calculator Gtm Payroll Services

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

Nanny Tax Calculator Gtm Payroll Services Inc

How To Create A W 2 For Your Nanny Nanny Tax Tools

Prepare Free Nanny Payroll With Our Excel Template Nanny Self Help